september child tax credit payment less than expected

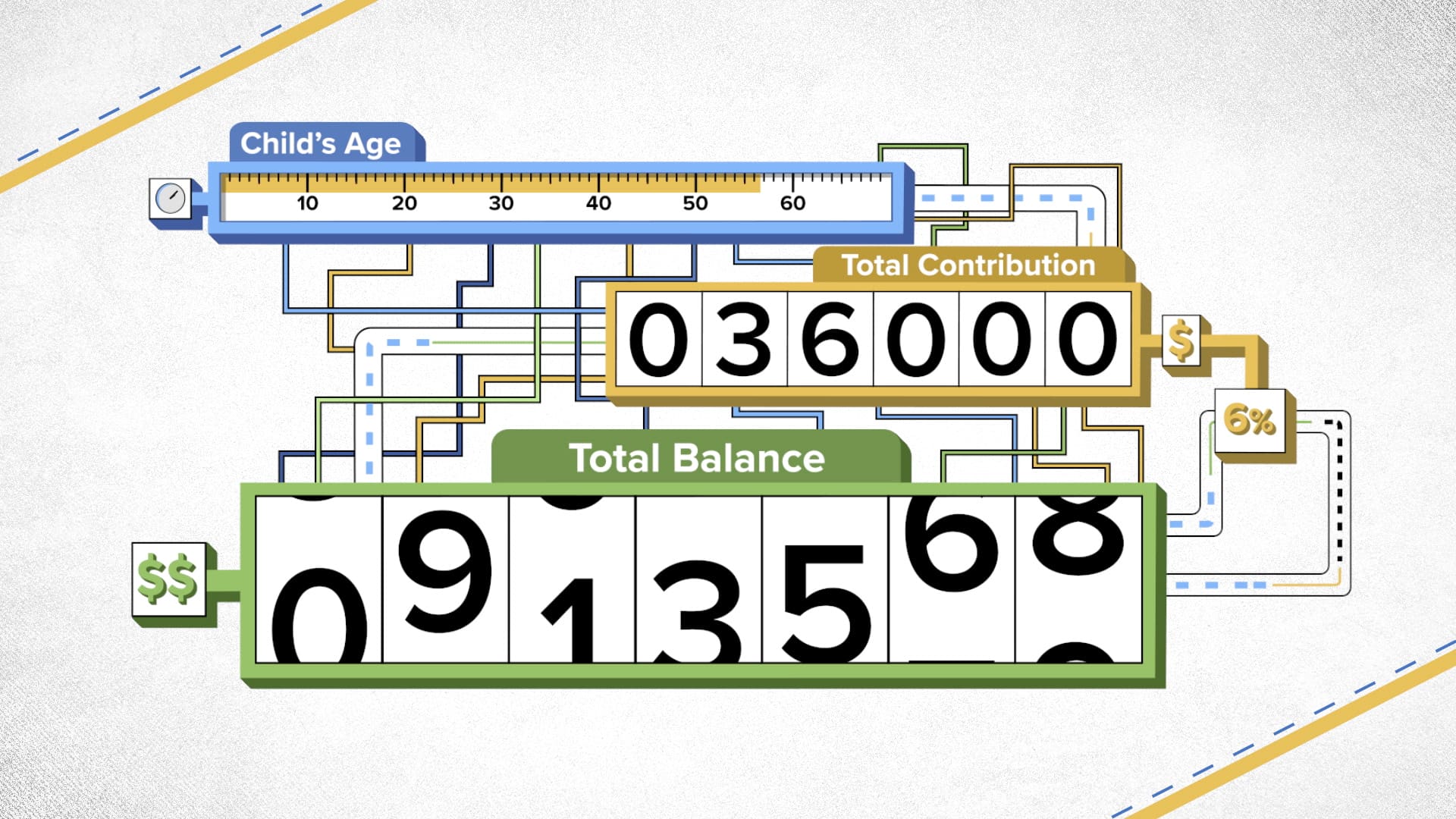

Families can receive 50 of their child tax credit via monthly payments between. 15 advance child tax credit payment on time but that the payments.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Since their MAGI doesnt exceed 400000 they qualify for the full 2000 tax credit for each of their two children adding up to a total of 4000all of which is fully refundable.

. Its also a good way to on pending payments. If you received less money than usual this could be why. SOME eligible parents are furious they are still waiting to receive their September child tax credit payments but the IRS is promising the check is on its way.

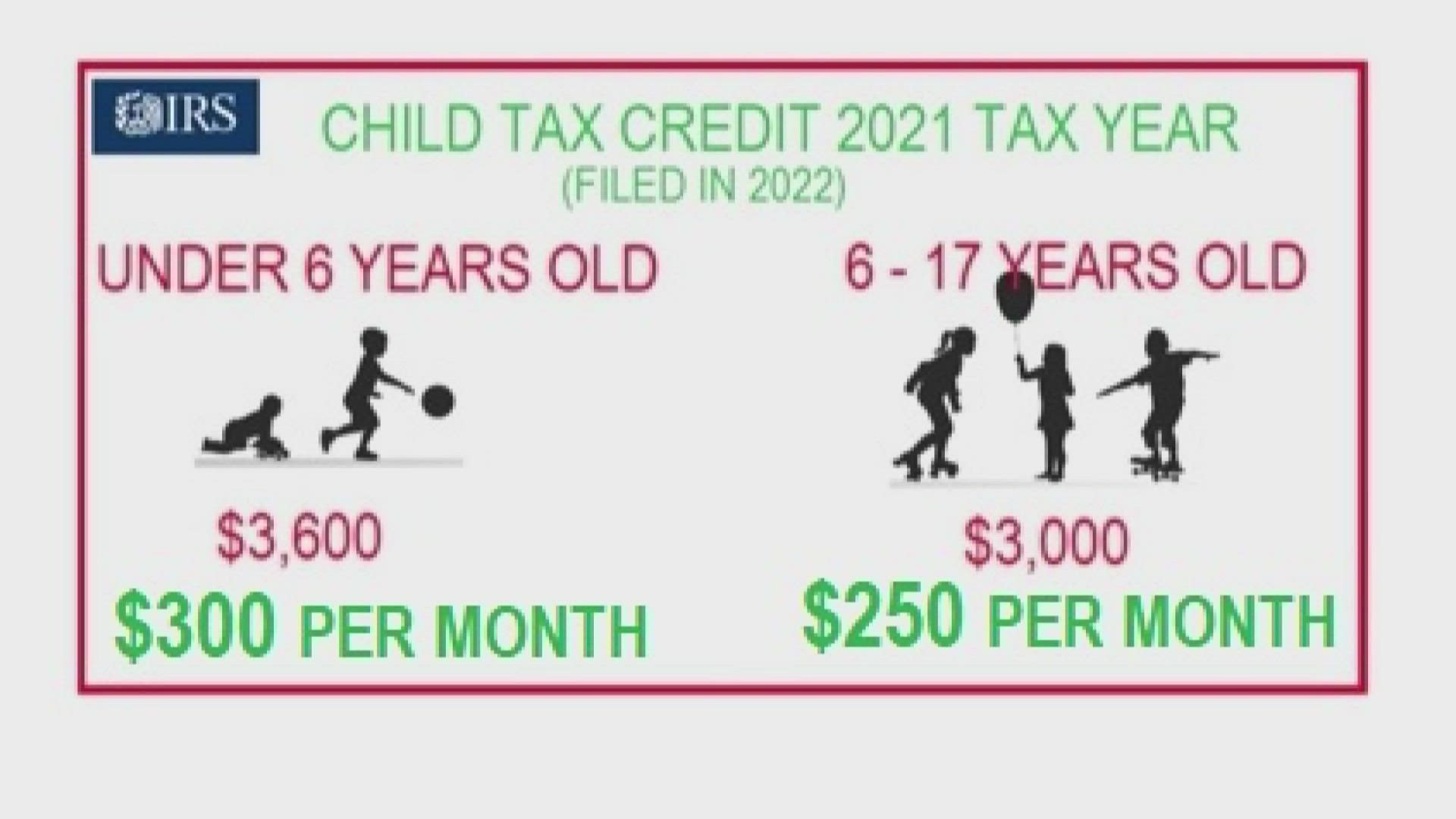

Children under the age of six will receive annual payments totalling up to 3600 so the monthly payments will be 300 per child. The third round of monthly payments of up to 300 per. The agency said that less than two percent of eligible families were delayed and they shouldve received direct deposit payments on Friday or will receive mailed checks in the.

This means stimulus checks will be deposited from. For every 1000 of income above the income thresholds above the credit is reduced by 50 a year until it reaches 2000 per child which works out to 166 a month. You can use the Child Tax Credit Update Portal to see your processed monthly payment history according to the IRS.

Each child under the age of six is entitled to 300 and 250 for kids between the ages of six and 17. About the child tax credit The first half of the credit will be sent as monthly payments of up to 300 for the rest of 2021 and the second half can be claimed when filing. Those aged between six and 17 will get 3000.

This means that each advance payment will be worth either 250 or 300 per child for parents jointly making less than 150000 per year or single parents making less than. The IRS said Friday that a technical issue prevented some eligible Americans from receiving the Sept. For these families each payment is up to 450 per month for each child under age 6 and up to 375 per month for each child ages 6 through 17.

If your income is above the threshold for your filing status your child tax credit payments. There have been numerous reports of incorrect or lower-than-expected payments for the most recent Child Tax Credit. For parents of eligible children up to age five the IRS will pay you up to.

The ARP increased the 2021 child tax credit from a maximum of 2000 per child up to 3600. According to a recent news release from the IRS some families received a different amount than they expected for September due to their 2020 tax returns having. Under the American Rescue Plan eligible families are entitled to monthly payments of up to 300 for each child 5 and under and up to 250 for each child 6 to 17.

The money from the overpayments is being taken out of the last three checks so these households are likely to see just a 10 to 13 decrease per child in the three remaining. Child tax credit payments are supposed to be sent out on the 15 th of every month but in August the date falls on a Sunday. If your December child tax credit check or a previous months check never arrived well tell you how to trace it.

The Internal Revenue Service is investigating why some parents are missing their September child tax credit payments.

Child Tax Credit Did Not Come Today Issue Delaying Some Payments King5 Com

Most Americans Support Biden S Expanded Child Tax Credit Our Research Finds But There Are Caveats The Washington Post

Advance Child Tax Credit Payments In 2021 Internal Revenue Service

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Why Is My Child Tax Credit Lower This Month King5 Com

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Child Tax Credit 2021 Why Opt Out Of Monthly Payments Money

You May Be Surprised By Cuts In October Child Tax Credit

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

Why Was Your Child Tax Credit Payment Less This Month Mcclatchy Washington Bureau

Biden S Child Tax Credit Pays Big In Republican States Popular With Voters Reuters

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit United States Wikipedia

Child Tax Credit United States Wikipedia

Publication 596 2021 Earned Income Credit Eic Internal Revenue Service

American Rescue Plan 2021 Tax Credit Stimulus Check Rules

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

September Child Tax Credit Payment How Much Should Your Family Get Cnet